CZ doesn’t actively favor or publicly buy many cryptocurrencies, but each time he does manage to stir up the market.

Retail investors fear being fleeced, but they fear missing out even more. CZ stands at the intersection of these two emotions; a single sentence from him can double someone’s money overnight, or wipe them out in the same night. Dramatic price fluctuations are commonplace in CZ-related stocks; it seems that once connected to him, price movements deviate from fundamentals and instead respond to sentiment.

![图片[1]-What’s happening with those who followed CZ’s trades?-OzABC](https://www.ozabc.com/wp-content/uploads/b37a7b4ab3e5f5bff154fe62dfc6ddb1-1140x570-1-800x400.webp)

CZ doesn’t actively endorse or publicly purchase many cryptocurrencies, but each time he does, he manages to stir up the market. On November 2nd, CZ posted that he used his personal funds to buy ASTER on Binance, along with a screenshot of the on-chain transfer (2.09 million ASTER tokens). The market quickly ignited, with ASTER rising from $0.91 to $1.26, a gain of over 30%.

According to on-chain analyst Ember’s monitoring, a whale shorted ASTER worth $50.62 million at a price of $1.20 after CZ bought ASTER. Currently, with the price of ASTER falling, this short position has a floating profit of over $12 million; while CZ’s previous purchase price of approximately $0.913 is currently at a floating loss.

This isn’t the first time CZ has “ignited” ASTER. During ASTER TGE in September, he forwarded a post and called for a trade, which propelled ASTER from $0.02 to $2.42, a nearly 7000% increase, making it the focus of the market.

On October 30th, ASTER taught the market a lesson: a KOL posted that CZ’s associated wallet sold 35 million ASTER tokens, causing the price to drop rapidly by 16.8%, with over $4 million in on-chain liquidation. Two hours later, Lookonchain and EmberCN pointed out that it was an internal transfer within a Binance hot wallet, and CZ also refuted the claim as “fake news,” allowing the price to recover its losses.

![图片[2]-What’s happening with those who followed CZ’s trades?-OzABC](https://cdn-img.panewslab.com/yijian/2025/11/6/images/df24f1097e0879487558bb7b8f9bc7ae.webp)

It’s fair to say that almost every major fluctuation in ASTER’s price action is inextricably linked to the name CZ. He stated that every time he bought cryptocurrency, he was 100% trapped in a short period: in 2014, he bought BTC at an average price of $600, which plummeted to $200 within a month and remained there for 18 months; in 2017, he bought BNB, which also fell by 20-30% and remained there for several weeks. This time, he added to his position after ASTER’s decline, and everything is still uncertain. He also reminded everyone to be aware of the risks and stated that he will no longer disclose his trading details to avoid affecting market trends.

Previously, CZ also stated that BNB accounted for over 98% of his personal holdings and he had never sold any. He bought BNB at $0.10 during the BNB ICO, and eight years later, the price of BNB has long since broken through the $1,000 mark, and its market capitalization has gradually surpassed SOL, currently ranking fifth in the crypto market.

BNB is CZ’s core asset. In August 2020, he publicly stated that BNB holders were the smartest; in June 2023, when facing a lawsuit from the SEC, he encouraged holding onto his positions; and on November 2, 2025, he stated that he had not sold any in eight years. It was precisely BNB’s long-term performance that provided credibility for his subsequent trading recommendations.

Besides BNB and ASTER, VANA is also worth mentioning, as this is the first project he participated in as an advisor (without explicitly making a purchase).

Vana is an AI-powered identity generation application. The VANA token was listed on Binance in December 2024, immediately surging to an all-time high of $35.8. As the only Data Autonomous Organization (DAO) listed on Binance, it perfectly capitalized on the Q4 AI boom. However, after the Data Liquidity Pool (DLP) opened in January 2025, data quality issues surfaced, causing the token price to plummet to around $6.

![图片[3]-What’s happening with those who followed CZ’s trades?-OzABC](https://cdn-img.panewslab.com/yijian/2025/11/6/images/6107e134ff1034f750b05b3f5e43a50e.webp)

On February 24th, YZi Labs announced a strategic investment in Vana. CZ (Crypto’s founder) was appointed as an advisor on the same day and posted, “Crypto is AI money, data is AI food,” instantly generating significant buzz. The VANA token surged over 50% in 48 hours. However, after the initial hype subsided, the project failed to materialize, and the price fell back to $2.8, a 92% drop from its peak. CZ had previously stated that he was an advisor, not a caretaker; while he invests in infrastructure, implementation relies on the team. This perfectly illustrates that while CZ’s advisory title can ignite market activity, it cannot ignite the fundamentals.

CZ Ignites the Fire, Community Fuels the Fuel: The Traffic Code to Meme Frenzy

As a public figure, CZ’s public mentions of certain cryptocurrencies naturally attract a large number of investors to copy his trades. Although he frequently tries to distance himself from certain meme coins, the copy trading effect created by the market is difficult to ignore. Especially after a large number of projects were listed on Binance Alpha, coupled with the FOMO effect, a single sentence is enough to stir up a huge wave.

Take SZN coin as an example. On October 7th, CZ posted that the BNB meme season had arrived, and the coin price surged 5600% in 24 hours. The “4” coin originated from a photo of CZ’s hand gesture; CZ has repeatedly used the number 4 in his posts to respond to fake news, and the community memeized it, resulting in a peak price increase of 2000%. BROCCOLI comes from CZ’s publicly revealed dog name, and its market capitalization reached $52 million in 2 hours. CZSTATUE is a meme coin based on a 14-foot-tall golden statue of CZ; CZ criticized it, but it still surged 3000%. PALU is derived from a cartoon avatar that CZ praised, and its market capitalization once exceeded $100 million. MAXI is a response to CZSTATUE; after CZ criticized it, it surged over 1500%. SCI6900 is a project that CZ shared about the Shanghai Composite Index being on-chain, and it surged 300% in 24 hours. In March 2025, CZ claimed to have bought TST and Mubarak for 1 BNB each as a test, and the two coins immediately took off (TST 50%+, Mubarak 300%+).

Furthermore, the recently viral Chinese meme coin “Binance Life” originated from He Yi’s reply to a netizen, “Wishing you a Binance Life.” Base founder @jessepollak then posted a video “Starting Binance Life Mode on the Base App,” which CZ immediately reposted, stating that “Binance Life” was the first Chinese platform launched on the Base App, originating from the BNB chain. This back-and-forth interaction propelled its market capitalization to over $500 million in a short period, and it was essentially hailed by the community as a “Chinese meme revival.” Looking back, these coins, which once enjoyed great success, have mostly seen significant pullbacks, with current prices generally falling by 80%-95% from their peak, and liquidity and attention have also noticeably cooled.

GIGGLE is a typical example. On September 21, 2025, after CZ publicly disclosed the BNB donation address for Giggle Academy on X, the price of GIGGLE issued on Four.meme surged rapidly, with a phase increase of approximately 14 times. CZ then stated that the GIGGLE token was not an official project, and subsequently, the price of GIGGLE plummeted by 80%.

However, GIGGLE saw significant price increases on its initial listing on Binance Alpha in October and on the day it was subsequently listed on Binance Spot. On November 3rd, Binance announced that starting in December, 50% of GIGGLE spot and margin trading fees would be donated directly to Giggle Academy; Giggle Academy responded that it would burn an additional 50% after receiving the donation. Following this announcement, while the overall crypto market experienced a correction in early November, GIGGLE trading volume surged and its price more than doubled.

![图片[4]-What’s happening with those who followed CZ’s trades?-OzABC](https://cdn-img.panewslab.com/yijian/2025/11/6/images/1c8b52a372a818e125b76f5778f9bfdc.webp)

From Binance Alpha to the spot launch, and then to the official announcement, each step resulted in exponential price increases. Although GIGGLE wasn’t officially issued by Giggle Academy, the community still capitalized on the hype, pushing the topic and sentiment to the forefront. This clearly demonstrates that in the world of memes, Binance remains the ultimate endorsement of traffic and confidence.

YZi Labs Investment Endorsement

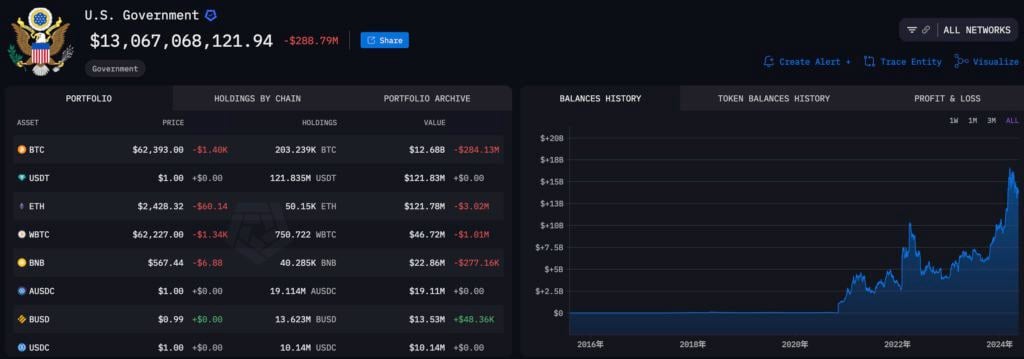

Besides CZ’s personal endorsement, YZi Labs’ investment backing also attracts market attention. According to publicly available information, YZi Labs has invested in over 20 projects this year, primarily focusing on infrastructure, settlement and stablecoins, and AI applications, while also considering RWA and Bitcoin programmability. Among these, projects that have already issued tokens include SIGN, VANA, EDU (Open Campus), and ENA (Ethena).

SIGN is an airdrop protocol that received a $16 million investment led by YZi Labs in January 2025, followed by a $25.5 million investment in October. On April 25, Binance announced that SIGN would be listed on the HODLer Airdrops page. In the first two days after listing, the price rose from $0.03 to $0.133, an increase of more than 3 times, before falling back and currently remaining around $0.08.

On September 19th, YZi Labs announced an increase in its stake in Ethena Labs, but the price of ENA reacted modestly. However, USDe TVL reached a peak of $14.15 billion that same month, before decoupling from USDe during the crash on October 11th, and the TVL has since fallen back to $9.5 billion. According to coingecko data, ENA currently has a market capitalization of approximately $2.3 billion, ranking 56th in the crypto market capitalization rankings.

On September 24, CZ publicly admitted on social media that he had invested in SafePal in its early stages. On the same day, the price of SFP rose from about $0.4 to about $0.7, an increase of more than 70%. The price has now fallen back to $0.3.

On October 20, YZi Labs participated in Open Campus’s $5 million strategic funding round. As the education sector is not a market hotspot, the token EDU performed poorly.

It’s worth noting that YZi Labs typically announces its investments only after the tokens are listed on exchanges, a timing that naturally amplifies event-driven price and volume spikes. However, from Vana’s lukewarm start to the subsequent lack of follow-through traffic for SIGN/EDU, it’s clear that the market doesn’t always respond positively to YZi Labs’ investment endorsement.

Conclusion

Ultimately, whether it’s CZ personally getting involved, coordinating with communities to create a meme atmosphere, or YZi Labs’ investment endorsement, the so-called “market recommendations” are just a spark, while the communities riding the wave of the concept are the tinder. Only when the two meet do they ignite the market. This also shows that the market itself needs hot topics to maintain attention and liquidity. However, a single spark can only illuminate the present, not sustain the future. What truly endures is the fundamentals.